Massive Fraud Uncovered in Unemployment Insurance Claims: A System in Crisis

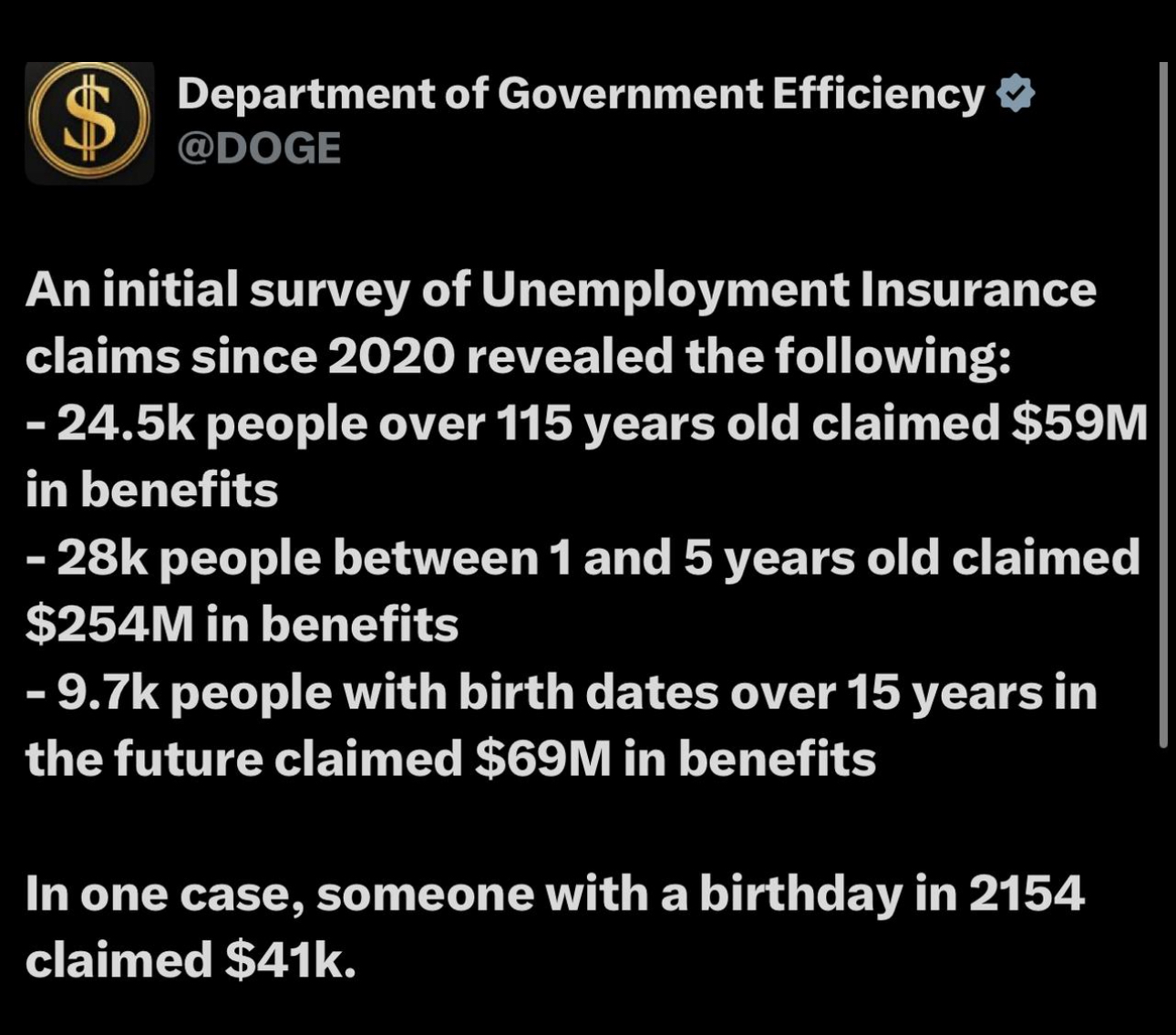

In a stunning revelation, the Department of Government Efficiency (DOGE) has released the results of an initial survey examining unemployment insurance claims since 2020, exposing a staggering level of fraud that has cost taxpayers billions. The findings, which highlight glaring vulnerabilities in the system, paint a troubling picture of systemic abuse and raise urgent questions about oversight, accountability, and the need for reform.

The Shocking Numbers

The survey uncovered a series of implausible claims that defy logic and point to widespread fraudulent activity:

- 24,500 claimants over 115 years old collectively received $59 million in benefits. The number of individuals in the U.S. over 115 is vanishingly small—estimated to be in the low hundreds at most—making it highly unlikely that tens of thousands in this age group were actively seeking unemployment benefits.

- 28,000 children between the ages of 1 and 5 were recorded as claiming $254 million. The idea of toddlers filing for unemployment is absurd, suggesting either rampant identity theft or deliberate exploitation of the system.

- 9,700 individuals with birth dates over 15 years in the future—meaning they haven’t even been born yet—claimed $69 million. This bizarre statistic indicates either a severe error in data validation or intentional fraud on a massive scale.

- In one particularly egregious case, a claimant with a recorded birthday in the year 2154 received $41,000 in benefits. This futuristic birth date, 129 years from now, underscores the complete lack of basic checks in the system.

These figures add up to hundreds of millions of dollars in fraudulent payouts, and this is just the tip of the iceberg. The survey’s findings suggest that the true scale of the problem may be far larger, potentially costing taxpayers billions over the past five years.

A System Ripe for Exploitation

The unemployment insurance system, designed to provide a safety net for workers who lose their jobs through no fault of their own, has long been a target for fraud. However, the COVID-19 pandemic exacerbated these vulnerabilities. In 2020, the federal government expanded unemployment benefits through programs like the CARES Act, which provided enhanced payments and extended eligibility to gig workers and others not traditionally covered. While these measures were critical for supporting millions of Americans during an unprecedented crisis, they also created new opportunities for fraudsters.

Scammers exploited lax verification